The agricultural sector in Ukraine plays a vital role in the national economy, acting as a system-forming component. It ensures food security, economic growth, environmental sustainability, and energy security. Approximately 71.2% of the country’s entire territory is allocated for agriculture, boasting highly productive land resources and a mild climate conducive to agricultural activities. About 16% of jobs are created by the agro-industrial complex, which also accounts for 10% of GDP, 30% of exports of goods, and one of the major budget-forming, export-oriented sectors of the economy. In recent years, this sector’s share of the consolidated budget of Ukraine has averaged 20%.

Industry’s volume

According to the U.S. Geological Survey, Ukraine possesses 32 million hectares of chernozem, one-third of Europe’s arable land. The country’s agricultural land covers an area of 43.375 million hectares, ranking sixth globally. In terms of exports, agricultural products accounted for $10.3 billion in the first half of 2019, reflecting an increase of $1.6 billion (18.6%) compared to the same period in 2018. The foreign trade turnover of agricultural products reached 13.1 billion dollars, or 25.1% of the total foreign trade turnover of Ukraine.

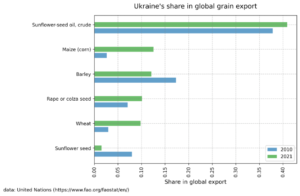

Notably, grain exports constituted 44.2% of total exports, followed by oils (22.9%) and oilseeds (6%). In 2021, Ukraine exported more than 40% of the world’s sunflower oil, more than 10% of the world’s corn and barley, and less than 10% of the world’s wheat and rapeseed. Exports of agricultural products increased by $1.5 billion (19.3%) to $9.5 billion. Exports of livestock products totaled 742.5 million dollars, an increase of 73.2 million dollars (10.9%).

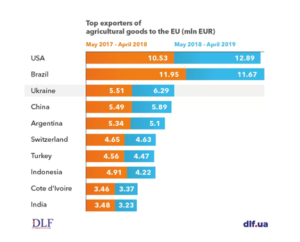

According to the regional structure of Ukrainian agricultural exports, Asian nations hold the top spot with a share of 41.9%, followed by EU nations in second place with 33%, and African nations in third place with 15.4%. China (9% of total exports), Egypt (8.2%), India (7.9%), Turkey (7.7%), and the Netherlands (7.1%) rounded out the top 5.

Opportunities and Growth Potential

The Ukrainian agricultural sector offers promising prospects for investors. The introduction of new technologies and the search for new markets present opportunities for increased production volumes and expanded export opportunities. Additionally, the recent decision by the Ukrainian parliament to open the agricultural land market creates favorable conditions for investment. Less than one year before the invasion, in June 2021, Ukraine opened its agricultural land market after two decades of a moratorium, which prohibited the trade of agricultural land.

Starting from 2024, foreigners will be allowed to purchase agricultural land up to 10,000 hectares, while Ukrainian citizens can acquire up to 100 hectares. According to the law establishing and regulating the land market, the right of purchase is granted exceptionally to individuals starting in 2021; firms must wait until 2024 to participate. Additionally, the law excludes government and public-owned lands from the market. Until January 1st, 2024, the upper bound of the size of land ownership by individuals is fixed at 100 ha; for the firm land ownership, it will be 10 000 ha starting in 2024. By investing in the agricultural sector, investors will contribute to Ukraine’s recovery and enhance global food security.

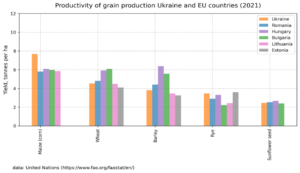

With around 6.9 million private landowners, 31 million ha or 75% of Ukraine’s agricultural land was under private control by 2020. According to the State Land Cadastre, however, only 29% of the land is farmed by landowners, with most of the agricultural property being used under rental agreements. By 2020, 117 largest companies controlled 16% (or 6,45 mln ha) of all agricultural land, predominantly through rental contracts. According to estimates of the Land Matrix Database, the foreign control of Ukraine’s agricultural land through foreign direct investment amounts to at least 3.3 mln ha, constituting about 10% of Ukraine’s arable land. According to official government statistics, large enterprises have more than 20% higher productivity than the country’s average productivity value.

War-Related Damages and Restoration Needs

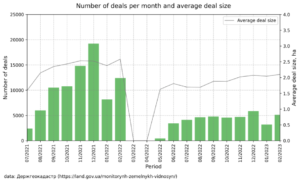

The full-scale Russian invasion caused significant damage to Ukraine’s agricultural sector, estimated at $4.29 billion, representing nearly 15% of its capital stock. Destruction of farmland, infrastructure, and agricultural machinery directly affects production capacity. The full-scale war has affected the work of Ukraine’s newly established agricultural land market. During March-April 2022, the market was closed, as the government had restricted access to the land ownership database. In May 2022, the Ukrainian government issued the war-time regulation for the land ownership register, and the land market slowly resumed its operations. In 2021, the monthly volume of operations was about 10 000 deals per month. This number has halved due to the war. Urgent restoration efforts are essential for Ukraine to regain its position in global food security.

Total losses are estimated at $23.3 billion and include indirect conflict losses to Ukraine’s agricultural sector in addition to the destruction of tangible assets and inventories. The indirect losses calculate the money lost as a result of lower production volumes and higher costs for producers because of the conflict. Given the extremely difficult situation in Ukraine’s agriculture, any support measures are needed and welcome. However, at this stage, it’s difficult to evaluate the effect of the already taken measures. Overall, ensuring smooth grain export should remain a priority for the Ukrainian government as stable grain export secures the country’s trade balance and contributes to macroeconomic stability.

Summary

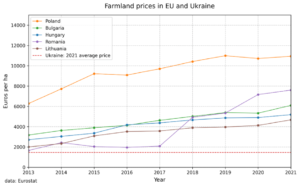

Despite the challenges posed by the war, the Ukrainian agricultural sector presents attractive investment opportunities. The country’s abundant land resources, favorable climate, and export potential make it an appealing destination for investors seeking long-term returns. Moreover, the farmland prices in the EU neighbors are around three times higher than it is in Ukraine. For instance, the farmland price in Hungary has increased by around 65% from 2013 to 2021.

The fundamental value of Ukraine’s land is challenging to estimate, the well-known fact is that one of the world’s most fertile soils covers two-thirds of Ukraine’s territory, making Ukraine one of the countries most suitable for agriculture. The opening of the agricultural land market and the availability of discounted investments provide a unique advantage. By participating in the restoration and development of Ukraine’s agricultural sector, investors will not only stand to gain profits but also contribute to the country’s recovery and global food security.

___________________________________________

This report was made by Ukrainian Marshall on June 25, 2023

Ukrainian Marshal is a team of experienced managers from Ukraine and the West that helps with the reconstruction of the country. Many head of states are visiting Ukraine with a lot of promises, funds from international organizations are presented, but most projects need private initiates to get alive. Our team is visiting many cities, understanding local needs and analyzing investment projects in production, logistics, agriculture, real estate, green energy, food, retail and many more industries.

We help to find international investors and to give those investors the right management support. Ukraine is moving towards European Union, many legals changes are on its way and corruption is considerably getting less. Despite the horrible war in parts of the country, now we see the right moment for international investors to come to Ukraine. It is important to create new jobs in Ukraine – for this reason we help Ukrainian producers to find new customers and international companies to settle down in Ukraine with very favorable economic opportunities. Soon, we will start our own Ukrainian Investment Fund where smaller investors will have the chance too to participate in the coming boom of the country.