Constant transition

In 2014 Ukraine laged behind the level of renewable energy use not only in economically developed countries, but also at global level. So, if the share of renewable energy in gross final energy consumption in the world amounted to 20%, in Ukraine this figure was only 4.2%. In recent years, Ukraine has achieved remarkable strides in its renewable energy sector, driven by its commitment to reducing reliance on natural gas and fortifying energy security. The government’s prioritization of renewable energy sources (RES) development is underscored by its efforts to curtail natural gas dependence. This strategic approach has led to the introduction of favorable feed-in tariffs, serving as a catalyst for promoting RES projects. Additionally, the discontinuation of residential gas and heat subsidies has propelled the allure of alternative-based heat generation.

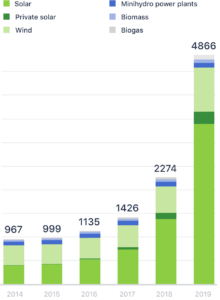

In 2018, Ukraine witnessed a substantial surge in renewable energy projects, with 347 ventures supplying electricity at competitive feed-in-tariff rates to the wholesale electricity market. The same year saw a threefold increase in contracts between energy supply companies and households for solar photovoltaic (PV) electricity, highlighting the growing popularity of this sustainable energy source. The momentum continued into 2019, as Ukraine experienced an accelerated deployment of renewable power projects. Impressively, total investments soared to EUR 3.7 billion, propelling the total installed capacity to an impressive 6,779 MW, marking a more than threefold expansion.

A significant driver behind the rapid growth of alternative-based energy generation can be attributed to the strategic phasing out of natural gas price subsidies in the residential sector between 2015 and 2016. This move not only rectified market distortions but also positioned biomass heat production as a viable and competitive alternative to gas-based heat generation. The enactment of draft Law No. 4334 further dismantled legal obstacles hindering biomass-based heat production. This legislation guarantees biomass heat production developers an enticing 90% of the tariff provided to natural gas heat producers, further incentivizing the transition. The State Agency for Energy Efficiency and Energy Saving (SAEE) predicts that this law has the potential to replace up to 3 billion cubic meters of natural gas with biomass in district heating production.

Ukraine’s commitment to sustainable energy development remains steadfast, with the country poised to capitalize on the potential of renewable energy sources, particularly biomass, while simultaneously enhancing energy security and reducing environmental impact.

In recent years, significant strides have been made in advancing energy efficiency policies and measures in Ukraine. However, the establishment of a well-coordinated policy framework, housing a comprehensive portfolio of programs to fully exploit Ukraine’s energy efficiency potential, is yet to be accomplished. An effective and harmonized policy structure would underscore market-driven pricing, regulatory oversight, fiscal incentives, technological advancements, and financial strategies.

The International Energy Agency (IEA) has crafted 18 pivotal energy efficiency recommendations for Ukraine based on its 2015 assessment. These recommendations served to enlighten Ukrainian stakeholders on paramount short- and medium-term energy efficiency policy priorities across diverse sectors like buildings, appliances, lighting, equipment, and industry. These encompass critical actions such as data aggregation from end users, securing financing, and the implementation of strategies, action plans, and protocols for rigorous monitoring, validation, and enforcement, all pivotal for policy triumph across sectors.

Post the formation of a new parliamentary coalition in April 2016, Ukraine’s parliament endorsed the government’s Action Program. Chapter 12, Energy Industry Reform and Energy Independence is dedicated to energy industry enhancements geared towards bolstering both energy security and efficiency. It outlines:

To translate this program into action, the Ukrainian government has formulated a draft Action Plan for 2020, publicly disclosed in December 2016. While the plan acknowledges excessive energy consumption in buildings as a critical hurdle and proposes measures to mitigate it, it tends to overlook several other pivotal aspects. These extend beyond specific sectors (industry, transportation, appliances, and lighting) to cross-sectoral concerns, including enhanced energy data gathering, refined National Energy Efficiency Action Plan (NEEAP), optimal utilization of private investments, and robust policy monitoring, assessment, and enforcement.

Searching for fuel alternatives

The landscape of fuel switching strategies and initiatives in Ukraine is marked by a multitude of proposals, programs, and plans. However, the origins and development of these strategies often lack transparency. A prevalent trend has been the inclination towards substituting natural gas with coal and biomass in the heating sector, prompted by the surge in Russian gas prices between 2010 and 2014. Unfortunately, the environmental implications of such transitions have frequently been disregarded or underestimated in cost-benefit evaluations of fuel alternatives. The feasibility of these large-scale endeavors is clouded by challenges in securing financing for multi-billion-dollar projects. Furthermore, the waning profitability of coal, a result of the conflict in eastern Ukraine, adds further uncertainty to the viability of these undertakings.

Nevertheless, recent years have witnessed remarkable achievements, including the implementation of pulverized coal injection (PCI) in the steel industry, a process replacing coal with natural gas. Successful application of this technology occurred at ArcelorMittal Kryvyi Rih and Metinvest Azovstal Iron and Steel Works in 2016, subsequently extending to all major steel mills within 2016-2021 period. Another notable project at ArcelorMittal Kryvyi Rih involves the substitution of natural gas with biomass, specifically sunflower seed husks, in lime production—an integral element of iron- and steelmaking processes.

Ukraine boasts an extensive framework of environmental legislation, encompassing a wide array of regulations, rules, and standards dedicated to efficient energy resource utilization, energy preservation, and renewable energy promotion. This framework comprises approximately 50 national standards, incorporating aspects such as energy efficiency methodologies, energy balance analysis, fuel consumption and loss regulation, energy labeling for household electrical equipment, energy management and auditing, and energy performance standards for specific equipment categories. The alignment of these standards with EU counterparts, in accordance with the Energy Community Treaty, represents a progressive trajectory for Ukraine’s sustainable energy future.

Ukraine’s dedication to combat climate change was further solidified in 2016 when it ratified the Paris Agreement. Pledging a targeted reduction of 60% of its 1990 GHG emissions by 2030, Ukraine’s journey towards sustainability was marked by overcoming significant economic challenges. The collapse of the 1990s post-Soviet economy, coupled with two recessions in the 2000s and territorial losses in 2014-15, led to a remarkable reduction in GHG emissions, currently standing at 39% of 1990 levels. Remarkably, even a robust economic resurgence up to 2030 would unlikely impede Ukraine’s commitment to the Paris Agreement. Ukraine’s strides are evident in the establishment of robust legal and institutional frameworks, alongside active participation in the Kyoto Protocol mechanisms of joint implementation (JI) and international emissions trading. The potential for further GHG abatement remains substantial, necessitating intensified efforts from both governmental bodies and industries. A focus on power sector modernization and energy efficiency enhancements not only advances environmental goals but also bolsters energy security.

With a rich history of coal exploitation, Ukraine’s potential in carbon capture and storage (CCS) is noteworthy. The existing coal industry and technical prowess position Ukraine favorably for future CCS endeavors. However, current clean coal priorities center on augmenting coal-fired plant efficiency and emissions reduction rather than direct CCS applications.

Ukraine’s energy research and development (R&D) landscape is concentrated on the nuclear sector, emphasizing safety upgrades and reactor extension plans. Collaboration, both international and interdisciplinary, is strongly encouraged, with the European Commission’s experience serving as a model. Additionally, Ukraine’s efforts in nuclear education, through academic institutions like the Kyiv Polytechnic Institute and Sevastopol National University of Nuclear Energy and Industry, underscore the nation’s commitment to nurturing a skilled workforce. While numerous research initiatives are underway across academia, energy technology R&D remains constrained by limited state funding. A concerted push is needed for enhanced professional training and research segments of R&D, a critical facet in propelling Ukraine towards a greener, sustainable future.

RES sector before the war

In recent years, Ukraine has emerged as a global powerhouse in renewable energy development. The year 2019 witnessed Ukraine’s entry into the prestigious TOP-10 countries worldwide for renewable energy advancement, and a remarkable feat followed in 2020 as the nation secured a spot within the TOP-5 European countries for solar energy progress. Notably, this exponential growth is underscored by a pivotal shift in investment dynamics, with funds pouring into new renewable energy projects surpassing those directed towards fossil fuel initiatives since 2019.

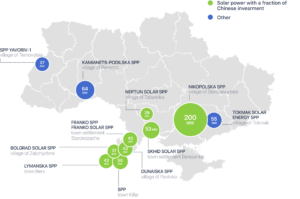

A decade of resolute commitment has seen international and domestic renewable energy investors infuse over USD 12 billion into Ukraine’s economy. The allure of Ukraine’s renewable energy sector has transcended borders, with foreign investors contributing substantially, capturing over 35% of the installed renewable energy capacity by the close of 2021. This prestigious list of contributors is headlined by prominent institutions like the European Bank for Reconstruction and Development, the Black Sea Bank for Trade and Development, the American International Development Finance Corporation, BayernLB, the Investment Fund for Developing Countries, and NEFCO, among a host of others. Global economic giants including China, the USA, Great Britain, Germany, the Netherlands, Sweden, Denmark, Norway, France, and more have solidified their roles as key contributors to Ukraine’s renewable energy landscape.

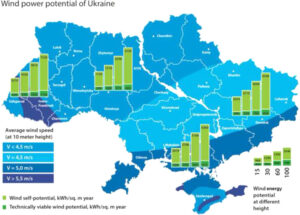

Wind energy, a cornerstone of Ukraine’s renewable energy narrative, retained its pivotal role, solidifying its second position after solar energy. Notably, the bulk of new capacities introduced to Ukraine’s “green” energy landscape in the past year came from the wind energy sector. A commendable 30.6%, amounting to 358.8 MW, was contributed by newly commissioned wind power capacities, marking an impressive 2.5-fold surge from 2020. Ukraine, boasting a proud history of 34 operational wind power plants before the onset of regional conflicts, remains steadfast in its commitment to an eco-conscious future.

The gas crisis that unfolded between late 2021 and early 2022 served as a stark affirmation of the immense potential held by Ukraine’s bioenergy sector (bioES). Against the backdrop of soaring natural gas prices, bioenergy emerges as a viable solution to partially bridge the gap in thermal and electrical energy production. Notably, 2021 witnessed the inauguration of 21 MW (equivalent to 1.79%) of biogas plants, a twofold surge compared to the preceding year, 2020. Small hydropower units also etched their presence, contributing 14.6 MW or 1.24% of new capacities in 2021.

The landscape of Renewable Energy Sources (RES) facilities mirrors the natural potential of each region. Wind power installations predominantly grace the southern and southeastern sectors, particularly adorning the shores of the Black and Azov Seas, accounting for around 85%. Solar generation paints a similar picture, with about 60% of industrial solar power plants clustered in the south and southeast of Ukraine.

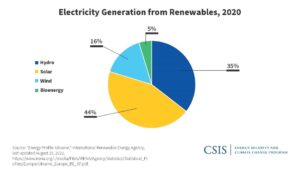

In 2021, the share of electricity harnessed from RES soared to 8.1%, generating a staggering 12.8TWh. Notably, solar power contributed 56%, followed by wind (33%), biomass and biogas (8%), and small hydropower (3%). The cumulative effort of RES power plants culminated in a commendable 12,804 million kWh of clean electricity – marking an impressive 17.8% surge from the previous year:

The year 2021 stands as a pivotal moment for the national RES sector, as May 11th witnessed a historic event where daily electricity generation from RES surpassed that of thermal power plants – an unprecedented achievement of 79 million kWh against 77 million kWh.

Significant strides in renewable energy projects translated into an annual reduction of over 10.3 million tons of CO2 emissions – an equivalent of emissions from 2.2 million cars.

Moreover, 2021 ushered in more ambitious objectives for Ukraine’s renewable energy arena. March 2021 saw the adoption of the National Economic Strategy of Ukraine through 2030, aiming for a 25% RES share in the country’s electricity balance by 2030.

Yet, the dawn of February 24, 2022, bore witness to the suspension of projects intended to enrich the business climate within the RES sector due to the Russian invasion. Consequently, Ukraine’s RES sector has entered a new and unprecedented reality, shaping the trajectory of its future endeavors.

RES sector during the war

Following the initial invasion, Russian military forces not only subjected Ukrainian cities to widespread bombardment but also launched targeted attacks on critical energy infrastructure. Alongside nuclear power facilities and transmission lines, renewable energy power plants quickly emerged as a secondary focal point for the invading Russian troops.

A significant proportion of Ukraine’s renewable energy facilities are geographically concentrated in the southern and southeastern regions, which have been embroiled in active hostilities over the past half-year. By August 2022, approximately 30–40% of RES power plants in these conflict-affected areas, equating to a substantial 1,120–1,500 MW of installed capacity, bore the brunt of the adverse impact.

The armed conflict exacerbated the prevailing financial crisis within Ukraine’s energy sector, escalating the urgency of financial constraints across all segments of the nation’s energy system. However, the reverberations were acutely felt within the renewable energy sector, where its very survival came into question.

Despite renewable energy producers, particularly those engaged in solar and wind energy, not receiving full compensation for their electricity contributions in 2021, they continued to shoulder operational expenses to sustain their power plants. Balancing their financial responsibilities toward the state, their workforce, and international investors, these producers chose not to oppose the financial policies governing the RES sector. Their rationale lay in recognizing the paramount significance of upholding stability and dependability within the power grid.

A subsequent evaluation of the electricity market’s financial landscape underscored that state entities such as “Guaranteed Buyer” and “Ukrenergo,” mandated by Ukrainian legislation to facilitate settlements with RES producers, possessed the necessary resources to bolster payments for “green” energy generation. The credibility of this viewpoint gained further traction with the commencement of commercial electricity exports to EU member countries. Notably, NEC “Ukrenergo” registered a noteworthy profit of UAH 1 billion within the inaugural month of exports. As gauged by renewable energy associations, NEC “Ukrenergo” and SE “Guaranteed Buyer” collectively held an estimated UAH 3.2 billion and UAH 12.7 billion during that time.

In response to official appeals and a strategic public relations initiative spearheaded by the RES sector, SE “Guaranteed Buyer” was mandated to allocate its funds solely toward settlements with “green” electricity producers.

Moreover, commencing June 2022, “Ukrenergo” initiated payments to RES producers situated beyond the occupied territories and actively generating electricity within Ukraine’s borders. Nonetheless, these settlements accounted for only 21% of the stipulated requirement, accentuating the sector’s ongoing challenges.

The aftermath of the Russian invasion has cast a long shadow over Ukraine’s energy landscape, profoundly impacting the viability of its renewable energy sector. The pursuit of innovative solutions, international collaboration, and strategic resource allocation emerges as crucial pillars for ensuring the sector’s survival and future growth.

Alongside the aforementioned financial challenges, Ukraine’s national wind energy domain confronts time-related hurdles in the execution of select wind power projects, as stipulated by existing legislation. In an endeavor to uphold investor trust within Ukraine’s Renewable Energy Sources (RES) market, the Ukrainian Wind Energy Association (UWEA) has advocated for an extension of project commissioning deadlines. This proposition is coupled with an extension of the “green” tariff, spanning the duration of martial law imposition, along with an additional timeframe essential for supply chain restoration. Nevertheless, this well-intentioned initiative has encountered formidable resistance within the Verkhovna Rada of Ukraine (VRU) Committee on Energy, Housing, and Utility Services.

A potential avenue for the resolution of this issue lies in the potential enactment of the “Law on Amendments to Some Laws of Ukraine Concerning the Extension of Renewable Energy Facility Commissioning Timelines within Electricity Purchase and Sale Contracts at the Green Tariff, Executed Prior to December 31, 2019.” Currently, this pertinent bill is undergoing a phase of comprehensive public discourse.

The vitality of this legislative adaptation cannot be understated, as it presents an opportunity to harmonize regulatory timelines with the practical complexities inherent in wind energy project implementation. By embracing this progressive amendment, Ukraine’s wind energy sector can fortify its growth trajectory, enhance investor confidence, and navigate operational challenges more effectively, ultimately contributing to a resilient and thriving RES landscape.

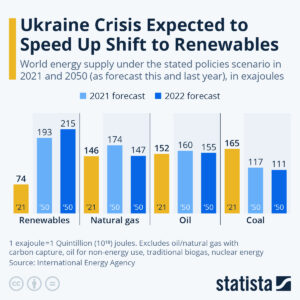

In a pivotal development, the European Commission greenlit the REPowerEU plan in May 2022. This visionary plan outlines the target of elevating the RES share within the EU electricity landscape to 45% by 2030, from the existing 40%.

The energy storage sector in Ukraine received a substantial boost through the passage of the “On Amendments to Some Laws of Ukraine Regarding the Development of Energy Storage Systems” legislation during the wartime period. This progressive law paves the way for large-scale energy storage system constructions within the nation’s borders.

Resuming “green” auctions underscores another stride by the Ministry of Energy. An August 2, 2022 announcement revealed that the Cabinet of Ministers endorsed a resolution delineating the auction schedule for 2023 and endorsed indicative quota benchmarks for the subsequent four years.

A noteworthy leap for the distributed generation market emerged with the Ministry of Energy’s introduction of the draft bill titled “On Amendments to Some Laws of Ukraine on Improving the Conditions for Production of Electricity from Alternative Energy Sources by Consumer Generating Installations.” This proposal outlines a fresh support model, encapsulated within the concept of net billing, demonstrating a positive signal for the distributed generation sector. Collectively, these affirmative decisions bear testament to the comprehension of renewable energy’s pivotal role in the post-war reconstruction process by state authorities.

Despite facing disruptions and damages to RES facilities, all RES-focused enterprises rallied in solidarity towards safeguarding Ukraine’s sovereignty and unity. These companies dedicated their efforts to supporting the Armed Forces of Ukraine, aiding local communities, facilitating personnel evacuation, and relocating their operations. Notably, during the initial 10–12 weeks of wartime, over 60% of Ukrainian wind energy companies channeled more than 1 billion hryvnias to bolster local communities, assist the Armed Forces, and aid refugees—a testament to the resilience and social responsibility of the renewable energy sector.

“Green” tariff and its potential cancellation

The principal catalyst behind Ukraine’s renewable energy advancement was the introduction of the “green” tariff. Enacted through the Law of Ukraine “On Alternative Energy Sources,” this tariff was established to encourage the generation of electricity from alternative sources, excluding blast furnace and coke gases. Hydropower, specifically from micro, mini, and small plants, was also eligible.

Moreover, VAT exemptions are applicable for imported goods used in personal production, provided similar quality goods are unavailable in Ukraine. This encompasses renewable energy equipment, energy-saving tools, measurement and control devices, materials for alternative fuel production, and more.

The Cabinet of Ministers of Ukraine outlines the list of applicable goods. Additionally, customs tax exemptions are granted for technical vehicles and self-propelled agricultural machines utilizing biofuel, as per the Law of Ukraine “On Alternative Fuels.” This exemption aids import and export operations and is governed by the Cabinet of Ministers of Ukraine.

Since March 2022, Ukraine’s government has debated suspending the renewable energy green tariff program amid war-driven budget constraints. However, experts warn this move could critically undermine energy security. Canceling green tariff payments would bankrupt over 8GW of solar and wind assets. Without domestic renewable generation, Ukraine will struggle to meet electricity demand this winter as Russia attacks energy infrastructure. Experts estimate Ukraine’s grid has already lost 4% of capacity, with another 35% in occupied territories.

Moreover, suspending the successful green tariff would erode investor confidence and contradict Ukraine’s renewable energy transition. It also misses economic opportunities – Ukraine’s fixed green tariff makes solar and wind power far cheaper than 4-5 times higher EU electricity rates through 2030. Leveraging competitive homegrown renewables could boost profitable exports to Europe while ensuring energy independence. Despite budget pressures, Ukraine should maintain green tariff incentives to enable continued clean power growth during conflict recovery in line with the EU’s REPowerEU strategy.

Upcoming potential

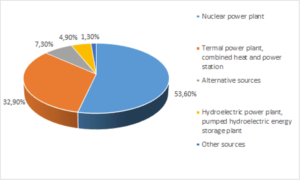

As of the end of 2021, Ukraine’s total installed capacities amounted to an impressive 56,169 GW, comprising various power sources. Thermal power plants of all types accounted for 49.7%, followed by nuclear power plants at 24.6%, hydroelectric power plants and hydraulic storage power plants at 11.2%, and power plants using renewable energy sources (RES) at 14.3%.

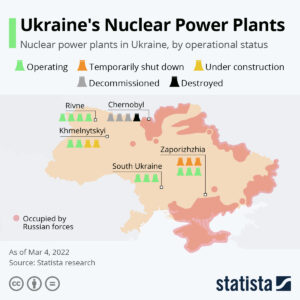

Nuclear generation served as the core of the country’s electricity generation, with 4 nuclear power plants boasting a capacity of 13,835 GW across 15 power units. However, by the end of 2021, 12 power units had already exceeded their normal 30-year operational life, with 10 more expected to reach the end of their “extended” licenses by 2030. Most Ukrainian nuclear reactors continue to rely on Russian nuclear fuel, which poses significant risks associated with import dependencies from the Russian Federation. Notably, during the winter period of 2021-2022, all 15 power units of the nuclear power plants operated simultaneously for the first time in Ukraine’s history. To balance the overloaded energy system, Thermal Power Plants (TPPs) with a total installed capacity of 21.8 GW are utilized. However, many of these TPPs are located in occupied territories, leading to decommissioning, repairs, and fuel shortages. Consequently, only 5-6 GW of thermal generation are presently available.

Recognizing the need for change, Ukraine plans to modernize or decommission a significant portion of its thermal generation capacities by 2033. Failure to achieve this goal will necessitate the shutdown of thermal capacities, resulting in a substantial reduction in installed thermal generating capacities to a mere 3,957 MW, of which only 882 MW will be practically available. In contrast, hydropower, with a total installed capacity of 6.3 GW, plays a crucial role in balancing Ukraine’s Unified Energy System (UES), particularly during peak electricity demand periods. However, the effectiveness of hydropower capacities is contingent on seasonal and weather conditions.

Given the current energy system’s limitations and exhausted resources of TPPs designed for constant operation, renewable energy power plants offer a promising solution. Wind and solar energy generation provide consumers with electricity independence from traditional fuel sources, effectively shielding the country from global fuel price fluctuations.

Reports suggest that Ukraine has a remarkable opportunity to phase out fossil fuels by 2050, aiming for an impressive 91% share of green energy in its energy demand. The transition to renewable energy sources (RES) hinges on relevant policies, energy efficiency measures, emission restrictions for thermal power plants, and the avoidance of new nuclear power unit construction. The envisioned transition will heavily rely on the energy of wind, sun, and biomass, with wind farms projected to reach a 45% share in electricity production, solar at 36%, and biomass and waste contributing up to 73% in heat energy production.

Even with the less ambitious scenario of perfect competition between energy producers, the share of nuclear power in Ukraine’s electricity industry is projected to decline to 13% by 2050 from 54% in 2015. This drop is attributed to the technical limitations of operating nuclear power plants and the high costs and extended timelines for constructing new nuclear facilities. In contrast, renewable energy technologies are rapidly decreasing in cost, making them a competitive alternative to nuclear power.

Future development

Before the war, Ukraine had already laid the groundwork for renewable energy development through various regulatory documents and national strategies. The Energy Strategy emphasized the importance of advancing Renewable Energy Sources (RES) generation, including the implementation of “smart” energy networks or Smart Grids.

According to the Economic Strategy, Ukraine aims to achieve a 25% share of RES in electricity production by 2030. Looking further ahead, the concept of Ukraine’s Transition to Green Energy by 2050, presented in 2020, set an ambitious goal of reaching a 70% share of RES in electricity production.

The ongoing war with Russia compelled the Ukrainian government to prioritize further RES development through the Ukraine Recovery Plan through 2032. This plan, presented at an international conference of donors in Lugano in July 2022, outlines key objectives for the post-war development of Ukraine’s economy. By 2032, the plan includes building 5-7 GW of new solar and wind power plants to enhance Ukraine’s export capacity, establishing 30+ GW of RES facilities for renewable hydrogen production, and constructing 3.5 GW of hydroelectric and pumped hydroelectric plants. The national program “Energy Independence and Green Course” is estimated to attract investments worth $130 billion.

Although the Ukraine Recovery Plan does not specify goals for offshore wind turbines, the World Bank recognizes Ukraine’s vast technical potential of 250 GW for offshore wind energy in the Black Sea. Capitalizing on this potential, the development of offshore wind energy will significantly enhance Ukraine’s export capabilities, as highlighted in the White Book “Offshore wind energy and “green” hydrogen: opening new frontiers of Ukraine’s energy capacity.” Prepared by prominent stakeholders like the Ukrainian Wind Energy Association, Asters law firm, the Ukrainian Hydrogen Council, and the Institute of Renewable Energy of the National Academy of Sciences of Ukraine, this report emphasizes the importance of offshore wind energy for Ukraine’s energy future.

The current war situation and Russia’s energy-related actions highlight the urgency of large-scale renewable energy development in Ukraine. By transitioning to RES, Ukraine can reduce its dependency on traditional energy resources, making it less susceptible to energy-based influence from external forces. Specialized European and Ukrainian RES associations, such as WindEurope, SolarPowerEurope, the Ukrainian Wind Energy Association, and the Solar Energy Association of Ukraine, advocate for Ukraine’s post-war reconstruction to be grounded in RES, aiming for a 50% share of RES in the electricity balance by 2030. Moreover, embracing renewable energy not only ensures electricity independence but also contributes to decarbonization in other carbon-intensive sectors, including transportation. Hydrogen, produced using renewable energy sources, offers a viable alternative to imported petroleum products, fueling various modes of transport.

While the economic and social benefits of renewable energy development are evident, realizing its potential requires proper state support and a favorable business climate. The Government of Ukraine faces the crucial task of retaining national and international investors in the renewable energy sector to drive sustainable growth and energy independence for the country.

___________________________________________

This report was made by Ukrainian Marshall on July 7, 2023

Ukrainian Marshal is a team of experienced managers from Ukraine and the West that helps with the reconstruction of the country. Many head of states are visiting Ukraine with a lot of promises, funds from international organizations are presented, but most projects need private initiates to get alive. Our team is visiting many cities, understanding local needs and analyzing investment projects in production, logistics, agriculture, real estate, green energy, food, retail and many more industries.

We help to find international investors and to give those investors the right management support. Ukraine is moving towards European Union, many legals changes are on its way and corruption is considerably getting less. Despite the horrible war in parts of the country, now we see the right moment for international investors to come to Ukraine. It is important to create new jobs in Ukraine – for this reason we help Ukrainian producers to find new customers and international companies to settle down in Ukraine with very favorable economic opportunities. Soon, we will start our own Ukrainian Investment Fund where smaller investors will have the chance too to participate in the coming boom of the country.

For more information, please visit us at www.uamarshall.com

Also, you can contact us at info@uamarshall.com