Construction is a crucial sector that correlates with a country’s economic well-being. In Europe, where macroeconomic conditions are stable, the construction industry contributes around 5-7% to the total GDP. In Ukraine, the share of construction in the domestic GDP has been gradually increasing. It grew from 2.3% in 2015 and reached 3.3-3.2% during the active spread of the coronavirus in 2020-2021.

The pandemic has had a significant impact on Ukraine’s construction industry, which heavily relies on global economic changes. Furthermore, the country faced challenges with its housing, as buildings have poor insulation and low energy efficiency. Buildings in Ukraine account for almost 40% of final energy consumption, with a considerable portion dedicated to space heating or cooling. Reliance on imported fossil fuels, especially natural gas, further exacerbates the situation.

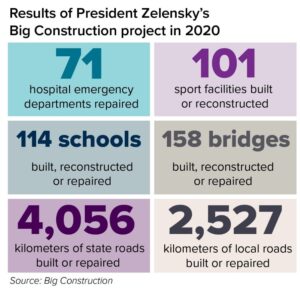

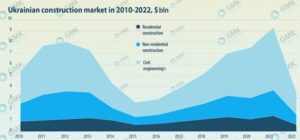

The pace of housing construction in Ukraine has significantly slowed down in 2020, the index of construction products in the residential real estate segment has amounted 81.5% of the 2019 volume, while the average price per square meter increased by 6.5%. On the other hand, non-residential and civil engineering constructions remained relatively stable, with some projects even surpassing the levels of 2019. The amount of non-residential construction remained nearly the same, with a rate of 99.3%, while civil engineering constructions surpassed the levels of 2019 with a growth rate of 111.6%. This was made possible through the implementation of the government’s program called “Big Construction”, which involved the repair of over 3.9 thousand kilometers of roads and the construction or reconstruction of 114 schools, 100 kindergartens, and 101 sports facilities.

Despite the challenges, adaptation to current conditions gained momentum in 2021 both in Ukraine and globally. The volume of new construction and building material production increased, albeit with delays and rising costs, primarily due to fuel price increases. According to GlobalData consulting company, the global construction sphere experienced a 6% growth in 2021.

“Big Construction” national program

Thanks to the Big Construction national program, over 14,000 km of roads in Ukraine have been upgraded and built within a span of two years. President Volodymyr Zelenskyy announced during the “Big Construction: Roads and Bridges” national forum in the end of 2021 that the program will be expanded next years to include projects aimed at modernizing border crossing points. The implementation of the program has transformed roads and bridges from mythical concepts into tangible modern structures.

The ambitious and popular building plan is needed to improve an aging road network of 46,000 km (28,583 miles) of national roads, 123,000 km (76,428 miles) of regional roads and 250,000 km (155,342 miles) of urban roads, for which a total investment of $4.5 billion (€4.1 billion) was foreseen, partly financed by the European Bank for Reconstruction and Development.

Despite initial skepticism and concerns about resource availability, funding, and building materials, the Big Construction program achieved significant results. In 2020, more than 6,500 km of roads were renovated or constructed and by the end of 2021, the number exceeded 7,000 km. Nearly 40% of Ukraine’s main road network, connecting large and small cities, towns, and important regions, has been renovated and built.

Opinion polls reflect the public’s recognition of the government’s achievements, with one-third of citizens considering road construction as one of Ukraine’s most important accomplishments in 2021. Positive changes in infrastructure have been acknowledged by over 60% of the population. President Zelenskyy emphasized the need to continue and expand the Big Construction program, particularly focusing on the development of border infrastructure.

The government’s efforts have garnered support from international partners such as the European Union, the World Bank, and the EBRD. The recognition signifies the effectiveness and quality of the road networks and infrastructure projects completed during pre-war period. Infrastructure development is viewed as a joint investment by citizens, especially during times of global crisis.

Prime Minister Denys Shmyhal highlighted the record restoration of almost 14,000 km of roads in two years, the highest number in independent Ukraine’s history. Minister of Infrastructure Oleksandr Kubrakov noted the significant increase in funding for roads of state importance, which has multiplied fivefold in two years. The cost of road works has decreased due to competition and mandatory project examination. The Big Construction program has created over 200,000 jobs, contributing to Ukraine’s GDP growth by 1.5% to 4% annually.

Actual issues

On February 24th, Ukraine faced a steep escalation of conflict with Russia, leading to the invasion and subsequent effects on the domestic construction materials market. The war-related factors have significantly reduced the scale of the market, causing challenges for the majority of enterprises in Ukraine, including working capital depletion within a year.

In response to the war, some construction enterprises shifted their focus towards assisting the Armed Forces by producing anti-tank hedgehogs, camouflage nets, and providing sand for strengthening strategic structures.

During the first half of 2022, a substantial percentage of enterprises had to suspend or limit production due to intense shelling, high gas prices, and low market demand. Notably, the production of clinker bricks in Ukraine declined due to active hostilities in the Donetsk region, where the main deposits of refractory clays, a raw material for clinker bricks, are located. Several enterprises involved in the production of raw materials and construction products for the Ukrainian and European markets were completely destroyed, such as the mineral wool plant in Zhytomyr, construction mixtures in the Donetsk region, and metal structures in Mariupol, among others.

In the second half of 2022, the damaged energy infrastructure posed a significant challenge to the full operation of enterprises, particularly in terms of electricity limitations.

Consequently, there has been a need to import raw materials and/or materials that were previously manufactured by Ukrainian manufacturers, leading to an impact on construction costs. Throughout 2022, prices for building materials have experienced an average increase of 60%, while construction works have risen by 30%, with expectations for continued growth in line with exchange rate fluctuations and inflation. The construction sector experienced a significant decline in steel consumption in 2022. According to Metinvest SMC estimates, steel consumption in Ukraine decreased by 55% in natural terms, amounting to 2 million tons. Additionally, the import/export of materials has been limited due to non-functioning ports and restricted land routes, which have hindered the scale of turnover.

As a result, the commencement of new construction projects has been hindered. According to the State Statistics Service, the area of commissioned housing in the first 9 months of 2022 reached 4.825 million m2, slightly higher than the 4.797 million m2 recorded in the first half of 2021. Furthermore, the volume of construction for engineering structures witnessed a significant decline of 67.1% year-on-year.

In 2022, the total volume of completed construction works in Ukraine decreased by 65.1% compared to 2021, amounting to UAH 113.8 billion. The negative dynamics in physical terms can be observed across different segments: housing construction declined by 60.3%, non-residential construction by 63.6%, and engineering structures by 67.1%. The total area of housing put into operation in 2022 decreased by 37.8% to 7.1 million square meters, while the area of accepted non-residential premises decreased by 49.6% to 2.5 million square meters. In terms of the overall volume of completed construction works, new construction accounted for 37%, repairs for 38.6%, and reconstruction and technical re-equipment for 24.5% in 2022.

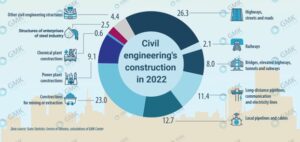

Due to the Russian aggression, the priorities of construction works have also shifted. In the structure of construction expenditures, the share allocated to the repair and construction of bridges increased from 1.8% in 2021 to 8% in 2022. Conversely, the share allocated to the construction and repair of roads decreased from 54.1% to 26.3% during the same period.

Gaps to be fulfilled

With the full-scale Russian invasion of Ukraine, numerous houses, enterprises, and educational institutions suffered severe damage. Now, the focus is on the restoration efforts in the reclaimed territories. However, the looming concern is whether we’ll have adequate building materials to facilitate the rebuilding process. The invasion not only destroyed many construction companies but also left several factories stranded in temporarily occupied areas. Additionally, supply chains underwent significant changes, while the demand for building materials surged.

Addressing the scarcity of crucial products like glass, plasterboard, building compounds, and insulation wool becomes crucial for ensuring a complete and thriving life. A challenging situation emerges due to the destruction of various factories and production facilities, as well as the disruption of mineral extraction sites by artillery fire or capture. For instance, Ukraine currently faces a plasterboard shortage, resulting in a substantial price increase for the available stock. Similarly, window glass will become scarce and costly. Additionally, construction mixes and insulating wool made of basalt will experience a deficit.

Fortunately, Europe has expressed interest in purchasing significant quantities of basalt wool from Ukraine for use in both construction and agriculture. This will help fulfill foreign contracts and secure foreign currency, which is vital in the current economic climate. Moreover, Ukraine previously received glass supplies from Russia, but now there are negotiations for glass supply from Turkey via the EU. Unfortunately, the situation has severely affected the glass factory in Lysychansk. However, the market has managed to self-regulate, with the prices of scarce products soaring, while goods with sufficient supply maintain stable prices.

Despite the challenges, Ukraine has ample reserves of rubble, sand, and cement from previously abandoned deposits, which are now being actively revived. However, the loss of Azovstal has led to higher metal product prices, resulting in a 100-120% increase in costs, with prices being recalculated weekly.

Currently, some goods are still available, and when a particular product is unavailable in one place, it can be found in another. However, the real test will come during the great reconstruction phase after the war, where there will likely be a significant deficit of construction materials on construction sites, making availability more critical than the previous focus on quality and price.

Rebuilding challenges

This year, the construction industry is experiencing positive changes that will greatly contribute to market improvement. One notable development is the resumption of work by construction enterprises, which had previously halted due to electricity shortages. The prospect of restoring the necessary power supply to producers is highly feasible, thanks to the conclusion of the heating period and the gradual recovery of the system. Effective air defense measures against repeated attacks on energy facilities also play a vital role in this process.

The second noteworthy aspect involves effective compensation programs for damaged or destroyed properties at both the state and local levels. Recently, a law was enacted to outline the specifics and procedures for such compensations. Additionally, several programs aimed at restoring housing have been initiated in the Kyiv region, but they are currently insufficient to bring about significant change. However, in the long term, these initiatives have the potential to positively impact the dynamics of the construction market and stimulate its growth.

Furthermore, the government is introducing mortgage programs as part of the revitalization of the sector. If implemented correctly, the opportunity to acquire housing at a low interest rate can have a positive effect on the market, as it keeps the program participants’ money within Ukraine. The plan for 2023 is to issue up to 15,000 subsidized mortgages, which will provide crucial support to the industry and consequently bolster the country’s economy.

The third crucial aspect is the establishment of a transparent reconstruction program. Estimates indicate that around three million Ukrainians have lost their homes, while approximately one-third of the infrastructure has been damaged. The recovery process is projected to require at least 350 billion dollars in state funding. To successfully implement such a program, transparency in all processes is paramount, not only for Ukrainians but also for international partners.

It is essential to address the challenges that are prerequisites for the stable development of the field. The foremost concern is the scarcity of construction materials, which were either imported from Russia (such as glass, cement, asbestos, gypsum, etc.) or produced in facilities that were destroyed by Russia. For instance, data from 2021 indicates that 70 to 80% of imported glass came from the Russian Federation and the Republic of Serbia. Therefore, it is crucial to anticipate the restoration of production capacity and explore investment opportunities in new enterprises. Recent research suggests that Ukrainian construction companies can produce 90% of the necessary materials for Ukraine’s reconstruction. Despite the war, destruction of certain facilities, and a shortage of human resources, the construction industry in Ukraine has managed to maintain its potential.

Another pressing issue is the excessive amount of construction waste, for which there is inadequate space in landfills. As of 2021, the landfill area reached 9 hectares, according to the Ministry of Regions. To address this problem promptly, new temporary waste collection sites are being established, with around 50 already present in the Kyiv region. The European experience demonstrates the successful reuse of construction waste, which will be particularly beneficial for Ukraine’s reconstruction. Instead of exporting sorted (harmless) residues for processing in the Republic of Belarus, it would be more advantageous to establish such a process within Ukraine.

The restoration of the construction sector will have a positive impact on the lives of the population and contribute to the post-war recovery of the country’s economy. It will generate employment opportunities, boost material production, and pave the way for the establishment of new enterprises. Therefore, it is crucial to be prepared for the rebuilding process, fully comprehend the challenges ahead, and initiate proactive efforts to overcome them.

Strategic approaches

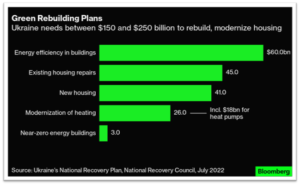

The housing sector in Ukraine has suffered the most significant economic damages from the war, totaling $48 billion. The intense shelling of Ukrainian cities, along with the need to relocate 4.5 million internally displaced Ukrainians, creates an urgent need for rapid and strategic rebuilding. The damage extends to critical infrastructure, including district heating and water supply, resulting in massive destruction.

According to estimates from KSE, around 132,000 residential buildings, along with numerous shopping centers, enterprises, offices, and other real estate, have been destroyed or damaged. The Ministry for Communities and Territories Development of Ukraine reports that 60% of the damaged buildings require major repairs, while only 25% have experienced minor damage. Therefore, immediate solutions must be implemented to provide accommodation, and strategic initiatives should be undertaken to improve living conditions with a focus on energy efficiency standards. The prerequisites for the post-war reconstruction of Ukraine’s housing and construction sector are as follows:

Conclusions

Ukraine should adopt European approaches to strategic planning and the implementation of state policies in the housing and construction sector. Investing in increased energy efficiency, modern materials, new communication systems, and bomb shelters may require significant upfront investments but will yield long-term financial viability as living standards rise, utility costs decrease, and housing becomes safer. Overall, after the war, the housing and construction industry, along with building materials production, can serve as drivers of economic growth in Ukraine.

___________________________________________

This report was made by Ukrainian Marshall on July 1, 2023

Ukrainian Marshal is a team of experienced managers from Ukraine and the West that helps with the reconstruction of the country. Many head of states are visiting Ukraine with a lot of promises, funds from international organizations are presented, but most projects need private initiates to get alive. Our team is visiting many cities, understanding local needs and analyzing investment projects in production, logistics, agriculture, real estate, green energy, food, retail and many more industries.

We help to find international investors and to give those investors the right management support. Ukraine is moving towards European Union, many legals changes are on its way and corruption is considerably getting less. Despite the horrible war in parts of the country, now we see the right moment for international investors to come to Ukraine. It is important to create new jobs in Ukraine – for this reason we help Ukrainian producers to find new customers and international companies to settle down in Ukraine with very favorable economic opportunities. Soon, we will start our own Ukrainian Investment Fund where smaller investors will have the chance too to participate in the coming boom of the country.

For more information, please visit us at www.uamarshall.com

Also, you can contact us at info@uamarshall.com