The ongoing war and influx of foreign investors have caused a significant decline in real estate prices in Ukraine. It is a well-known phenomenon that substantial fortunes can be made during times of conflict, and this observation holds true in the current Ukrainian real estate market. The country is currently facing a severe crisis and an unstable situation, which has led to a sense of excitement and uncertainty about the future. Despite the challenging circumstances and the economic issues, we are currently experiencing, including those in the real estate market, it is indeed feasible to consider purchasing properties in Ukraine.

Presently, if you take a drive through Kyiv, you’ll witness a surge in construction activities, with numerous high-rise apartment buildings, townhouses, and single-family home developments being erected. Despite the ongoing war with Russia, the construction industry in Kyiv is thriving as it anticipates an influx of people from the devastated cities and suburbs like Kharkiv, Mariupol, Kherson, and more. Moreover, once the war concludes, Kyiv will experience a significant influx of foreign companies and their employees, creating a demand for housing and office spaces. Although it may appear unusual to the average person, this is actually an opportune time to make profitable real estate investments in our country. Notably, the current market is characterized by minimal sales activity, as everyone awaits the end of the war, and bank financing options are limited. As a result, prospective investors with available cash hold a significant advantage in negotiations.

In other words, real estate prices are at their lowest point ever right now, and Ukraine will undoubtedly end this conflict soon. This is the ideal time to make a business-related real estate investment in Ukraine.

Real estate market trends

Throughout 2021, Ukraine experienced significant growth in construction volumes, showcasing a stable trend. Compared to 2020, the construction products index rose by 105.1%, driving construction activities in 13 regions of the country.

In the primary market, residential real estate prices surged by 25-30% in 2021. The highest-priced apartments, located in new buildings in Kyiv, saw a remarkable increase in value. At the beginning of the year, the approximate price per square meter was UAH 28,000, which escalated to UAH 35,000 by the year’s end. However, despite the constant reports of danger from Russia, the primary market experienced a sharp decline in demand. Experts attribute this to the rising construction costs. Surprisingly, even in the face of decreased demand, prices continued to rise, with a further increase of 1.3% to 10% at the beginning of 2022.

Unfortunately, the onset of the full-scale military invasion by the Russian Federation in March 2022 resulted in a halt in new construction projects and real estate sales. Developers notified investors that they would temporarily suspend accepting payments for apartment purchases. While fines were abolished, construction activities came to a complete standstill.

Due to the non-functioning State Register of Rights to Real Estate since the beginning of the war, realtors were unable to formalize purchase and sale transactions. Buyers were cautioned against seeking legal loopholes, such as making purchases through wills, as these agreements would not hold legal enforceability.

By May, partial access to the registries was restored, excluding regions where hostilities persisted. The government has implemented specific guidelines for notaries and imposed necessary restrictions during martial law. Since then, only individual purchase transactions have been officially recorded.

Investment options

As spring progressed, construction companies in Ukraine resumed their work, with more than half of the projects that were active on February 24 back in operation by May. The market responded swiftly with a significant price surge as construction gradually picked up pace. In May, the average prices for residential complexes in Kyiv reached UAH 52,272 per square meter, marking a 16.2% increase from the beginning of the year. However, by June, prices had already declined to 46,905 UAH, representing a 4.2% increase compared to January.

For foreign investors seeking income-generating projects, two viable options exist. The first option is to purchase apartments for rental purposes, either for residential or office use. The second option involves acquiring standalone buildings and the underlying land, which can be renovated and resold, commonly known as “flipping houses.” Distress sales often offer especially profitable opportunities in this regard.

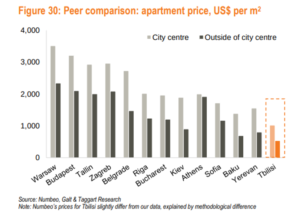

Investing in apartments in Kyiv presents an excellent choice for mid-size investors who lack the funds to purchase properties in cities like London or New York. Moreover, property maintenance expenses in Kyiv, including taxes and condo fees, are comparatively low. Savvy investors can capitalize on this by renting out the apartment and selling it at a later date when its value appreciates. So, how does a foreign investor navigate the process of buying an apartment in Kyiv?

Many investors focus on older apartments located in the center of Kyiv due to the prohibitively high prices of new constructions in prime areas. However, when dealing with older properties, it is crucial to conduct a thorough inspection. These apartments, whether renovated or not, may have legal and practical issues such as encumbered ownership rights, unregistered construction, fungus problems (especially in showers), leaky pipes (sewage, water, gas), and more. It is advisable to engage experienced lawyers, reliable property inspectors, or knowledgeable handymen to assess and address any potential problems.

When it comes to investment opportunities, comfort and business-class properties, particularly apartments with an area of up to 60 square meters, are considered the top choice. Buyers are willing to pay a premium for quality housing, additional amenities, and services available within residential complexes. These factors cater to various human needs, including food, entertainment, shopping, training, education, and more.

Given the high demand in the rental market, many individuals purchasing apartments as income-generating assets prefer projects that integrate home, work, and leisure aspects. This significantly enhances the value of rental properties. Additionally, there is a growing trend of buyers wanting to purchase apartments in new buildings to undertake immediate renovations. This year, there will also be an increased demand for developer-assisted finishing services for a supplementary fee.

Developers have been strategically allocating the first floors of buildings for commercial real estate purposes for several years, and this trend will continue to expand in 2023.

The investor landscape will largely consist of Ukrainians working in the IT sector, who earn income in US dollars. Additionally, experienced investors with over 20 years of experience in primary real estate investments will continue to participate in this market. As for foreign investors, those from China and Israel emerge as prominent leaders in this field.

Expected profitability

Despite the relatively low demand, real estate prices in Ukraine continue to experience rapid growth compared to the pre-war period. This upward trend can be attributed to various factors such as increased logistics costs, labor shortages, rising building material prices, exchange rate fluctuations, and new legislation imposing additional expenses on developers.

According to data from the State Property Fund, real estate sales in Ukraine have decreased by 4.6 times since February 24, 2021, with the sale of housing constituting the largest share. Investors who had invested in the early stages of residential complex construction at the end of 2021 are likely to achieve lower profits in 2023 than anticipated. Initial calculations were based on an expected price increase of 30-35% over the entire construction cycle. However, even without considering the project’s quality, the profit margin is not expected to exceed 20%. Moreover, the level of profit is influenced by government initiatives granting buyer rights to investors in the primary market. This entails a tax burden, particularly for investors who have not only invested funds to safeguard against depreciation but also for professional investor categories such as rentiers. In 2021, this investor category accounted for approximately 15-20% of total apartment sales by developers.

Currently, the primary housing market remains the focal point for the majority of investors, although investment priorities may slightly shift the yield from other segments. One promising segment is service apartments, which offer both development and investment potential. By the end of 2021, the average annual return on investment in this segment ranged from 10-12%, providing a highly competitive return compared to the primary housing market. Additionally, this profit can be consistent, unlike the primary market where the return on investment can take 7-20 years to materialize.

___________________________________________

This report was made by Ukrainian Marshall on June 27, 2023

Ukrainian Marshal is a team of experienced managers from Ukraine and the West that helps with the reconstruction of the country. Many head of states are visiting Ukraine with a lot of promises, funds from international organizations are presented, but most projects need private initiates to get alive. Our team is visiting many cities, understanding local needs and analyzing investment projects in production, logistics, agriculture, real estate, green energy, food, retail and many more industries.

We help to find international investors and to give those investors the right management support. Ukraine is moving towards European Union, many legals changes are on its way and corruption is considerably getting less. Despite the horrible war in parts of the country, now we see the right moment for international investors to come to Ukraine. It is important to create new jobs in Ukraine – for this reason we help Ukrainian producers to find new customers and international companies to settle down in Ukraine with very favorable economic opportunities. Soon, we will start our own Ukrainian Investment Fund where smaller investors will have the chance too to participate in the coming boom of the country.